- Real Estate 3.0

- Posts

- Tokenization Isn’t Crypto — It’s Business Infrastructure

Tokenization Isn’t Crypto — It’s Business Infrastructure

For too long, “tokenization” has been trapped in the language of crypto.In reality, it’s the quiet revolution modernizing the global economy — turning ownership, contracts, and yield into programmable, verifiable, and instantly tradable digital units.This isn’t about speculation. It’s about infrastructure.

Developers today face the same structural problem as twenty years ago:

trust, speed, and liquidity.

Property transactions are still slow, manual, and fragmented.

Contracts live in PDFs, settlements take weeks, escrow is offline, and compliance is reactive. As a result, even world-class projects suffer from one thing: friction.

Every layer of friction — a document, a notary, a wire transfer — slows down cashflow.

And friction kills velocity.

But tokenization removes it.

From Data to Value Infrastructure

When the internet digitized communication, businesses gained speed.

When blockchain digitized value, businesses gained trustless verification.

Tokenization does for ownership what the internet did for information — it makes it programmable.

A property can become a tokenized unit — a digital proof of ownership rights.

A contract can be executed automatically when milestones are met.

A payment can be released instantly when evidence is verified.

A resale can occur with full transparency and automatic compliance.

It’s not about replacing laws — it’s about encoding trust into business logic.

Why This Matters for Developers

Tokenization gives developers a new infrastructure layer — one that merges trust, liquidity, and automation.

Think of it as replacing your manual operating system with one built for instant, global collaboration:

Legacy Model | Tokenized Model |

|---|---|

Bank wires and PDFs | Smart contracts and live dashboards |

Offline escrow | On-chain escrow with milestone logic |

Local buyers | Global investor pool |

One-time sales | Ongoing, fractional liquidity with encoded royalties |

Manual audits | Built-in transparency |

In the same way you moved your marketing to social media, your operations to SaaS, your accounting to the cloud — you now need to move your value to the blockchain.

The Proof Is Already Here

Over $1.2 trillion of tokenized real-world assets are already live, and the number is growing 10x faster than the early internet.

Stablecoins now process over $12 trillion per year — more than Visa.

Institutional players like BlackRock, Franklin Templeton, and HSBC are building their own tokenization platforms for funds, treasuries, and bonds.

This isn’t a crypto experiment. This is financial infrastructure 2.0.

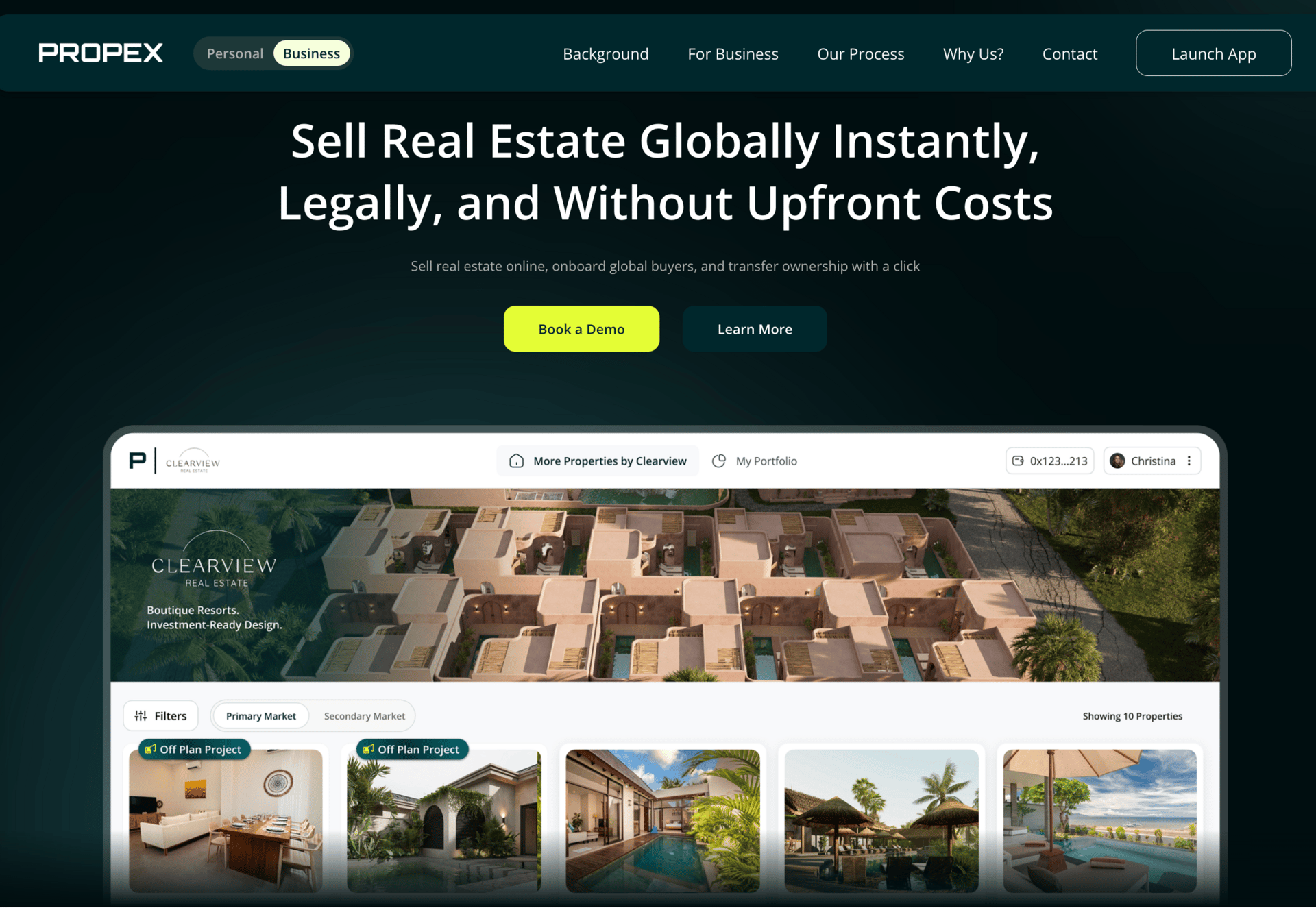

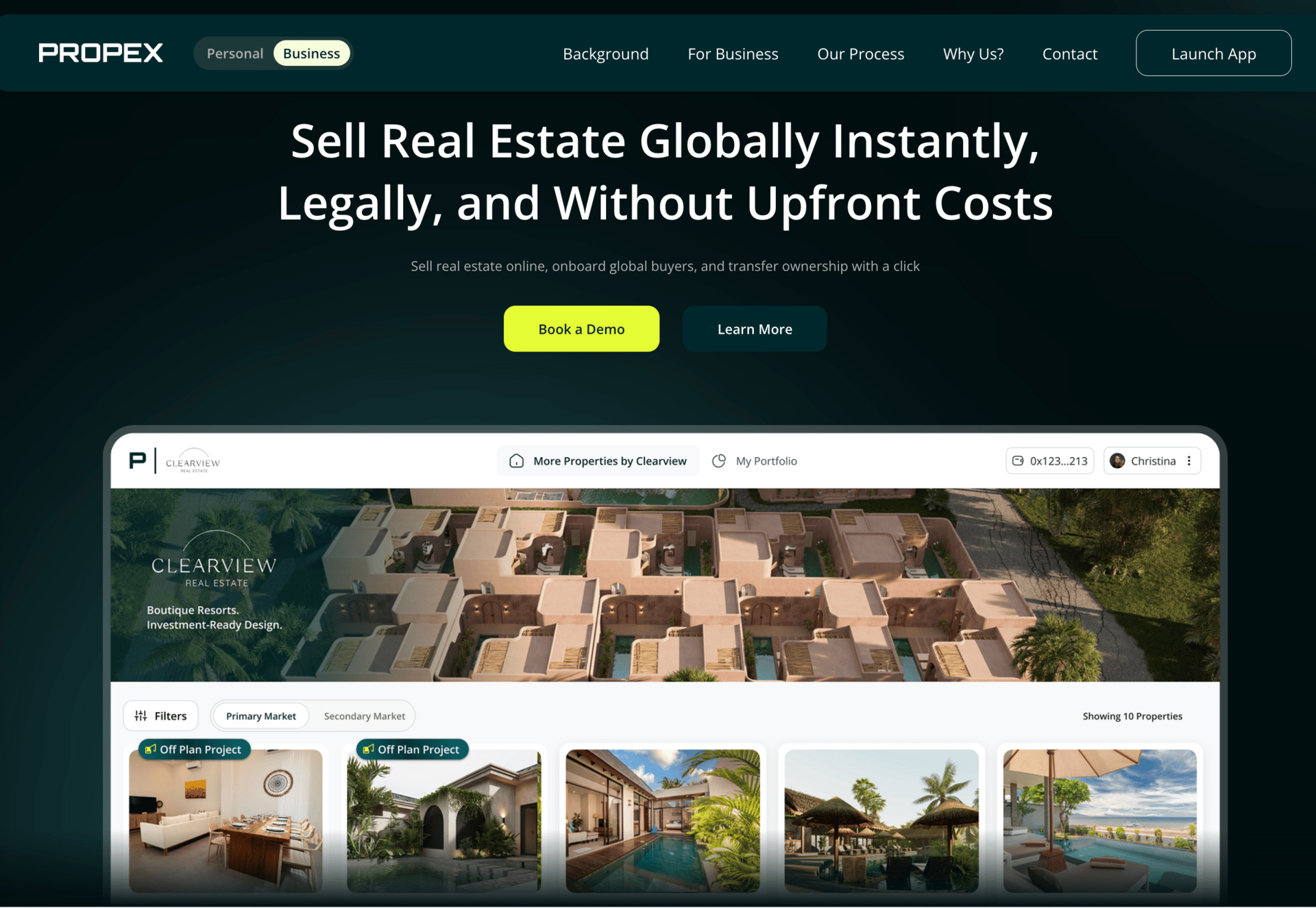

Propex: Infrastructure for Real-World Builders

At Propex, we built tokenization for the real estate industry — not as a buzzword, but as a better way to operate.

Our platform helps developers, builders, and management companies:

Digitize contracts into verified smart agreements.

Tokenize ownership through Series LLCs.

Automate investor payments and milestone releases.

Accept both fiat and stablecoin — frictionless, compliant, global.

Offer instant resale and transparency through investor dashboards.

We don’t just tokenize assets — we build business infrastructure for the digital economy.

Launch Your Online Real Estate Shop With Propex!

Every major shift in history begins quietly — then suddenly becomes inevitable.

In 2000, businesses that ignored the internet became irrelevant.

In 2025, those who ignore tokenization will lose to speed, trust, and transparency.

The question is not if your business will go on-chain — but when.

Property developers, Propex helps you get there first.

Book a demo and see how we can turn your operations, investors, and contracts into a frictionless on-chain ecosystem — without changing what you build, only how you deliver it.

👉 Book a Demo now or learn more by visiting our website.