- Real Estate 3.0

- Posts

- Inflation Erodes Your Money — And Here is The New Way Investors Are Fighting it back.

Inflation Erodes Your Money — And Here is The New Way Investors Are Fighting it back.

Most people know prices are rising. Most people feel stretched. Most people sense something is “off” with money. But very few people know that it all traces back to a single year that quietly rewired the global economy. Let’s break down what happened... and more importantly, what you can do about it today.

The System Broke in 1971 — And Never Went Back

This is the year that changed money forever — and the year that explains why your rent, your house, your tuition, your groceries, and even your savings feel like they’re slipping further out of reach. In August 1971, President Richard Nixon pulled the U.S. off the gold standard.

This decision — known as the Nixon Shock — had three major consequences:

Money was no longer tied to anything real.

It became purely political and elastic.Wages were frozen, even as prices began to rise.

Banks were encouraged to lend, allowing consumers to borrow money instead of earning more.

This was the beginning of the debt economy.

From that moment forward, the rules of money changed.

Instead of earning your way to a home, a car, or education, society shifted to borrowing your way to them.

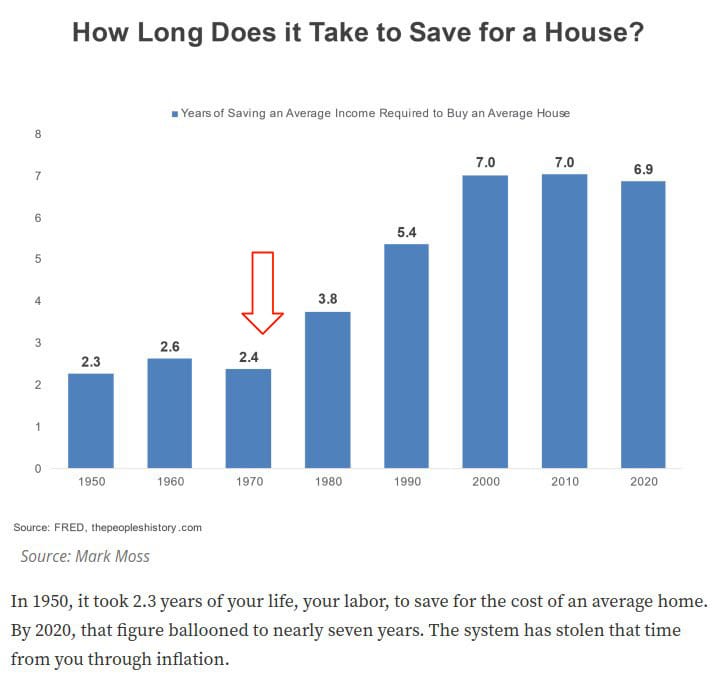

The Cost of Everything Exploded — Except Your Income

Let’s look at the data.

If you take the 1971 prices and adjust them to 2025 dollars, here’s what they should cost today:

Item | 1971 (inflation-adjusted to 2025) | 2025 reality | Difference |

|---|---|---|---|

House | ~$201,600 | ~$360,000 | +80% above inflation |

Rent | ~$1,200/mo | ~$1,743/mo | +45% above inflation |

Car | ~$28,480 | ~$48,841 | +71% above inflation |

Harvard tuition | ~$20,800 | ~$59,320 | +185% above inflation |

Gasoline | ~$3.20 | ~$3.15 | On par with inflation |

A few things stand out:

Housing skyrocketed far faster than inflation.

Education costs exploded.

Rent grew aggressively.

Cars became almost twice as expensive in real terms.

But income? It didn’t keep up.

Adjusted for inflation, the 1971 average income should be ~$85,000 today.

The typical American salary is nowhere near that.

The result?

You’re not imagining it — you really do get less for your money today.

Not because you’re bad with money.

Because the system changed.

The Era of Silent Erosion

Since 1971:

Prices rise.

Wages stagnate.

Debt increases.

Savings lose power.

Property ownership drifts further out of reach.

This is why millions feel like they’re running in place, even if they earn well.

Inflation isn’t just a number. It’s a wealth transfer mechanism — from savers to asset owners.

The people who protect themselves don’t do it by working harder… They do it by owning the right things.

How Smart Investors Beat Inflation

Here are the 5 proven ways ordinary people outperform inflation:

1. Own productive assets

Real estate, stocks, income-producing businesses — historically, they outpace inflation.

2. Automate investing (DCA)

Consistent contributions beat timing and compound faster than CPI.

3. Eliminate toxic debt

High-interest debt grows faster than inflation and kills purchasing power.

4. Increase your earning capacity

Skills that grow faster than prices protect your lifestyle.

5. Build a resilient portfolio

A mix of equities, real estate, commodities, and asymmetric assets protects you across cycles.

These principles are universal.

They work across countries, decades, and economic environments.

But one stands above the rest:

Owning real estate.

Not because it’s hype. But because it’s mathematically, historically, and economically the strongest (after Bitcoin, but we will talk about this one in another post) long-term inflation hedge humans have ever used.

Real Estate Is the Ultimate Inflation Hedge — But the Old System Is Broken

Here’s the problem:

Real estate became expensive.

Financing is restrictive.

Down payments are huge.

Transactions are slow and paper-heavy.

And global investors can’t easily invest in foreign markets like Bali, Thailand, Portugal, or California.

The desire to own real estate is universal. But the system for owning it is outdated.

This is where modern solutions emerge — not as hype, but as necessity.

Where Propex Fits Into the New Reality

Propex exists because the world after 1971 no longer works with the old property model.

If inflation erodes your purchasing power, and assets are the only reliable protection, then access to real estate should be simpler, faster, and borderless.

Propex enables exactly that:

Buy shares in high-yield villas, resorts, or developments — regardless of where you live.

✔ Fractional ownership starting at small amounts

No need for $150,000 down payments or massive loans.

✔ Digital, liquid, transparent

Blockchain rails make ownership easier to verify, transfer, and manage.

✔ Income-producing assets

Earn yields, benefit from appreciation, and hedge against inflation through real, cash-flowing property.

✔ Legally structured through U.S. Series LLCs

Institutional-grade compliance for global investors.

This isn’t theory.

This is the modern way to own real estate in a world where money loses value every year.

A New Era of Wealth Protection

1971 changed everything about money.

2025 is changing everything about ownership.

The winners of the next decades won’t be the people who save the most.

They’ll be the ones who own the most — even in fractional form — across the best global markets.

Inflation is not the enemy.

Being unprepared is.